capital gains tax rate california

California does not have a lower rate for capital gains. California does not have a tax rate that applies specifically to capital gains.

Search Search Home About Our Experts Our Achievements Events Subscriptions What S New National Security Health Care Health Care Publications Health Care Commentaries Health Care Newsletters Kellye Wright Fellowship Health Policy Blog Taxes

This includes stocks bonds mutual funds real estate and personal property.

. This is maximum total of 133 percent in California state tax on your capital gains. Taxpayers in the 10 and 15 percent tax brackets pay no tax on long-term gains on most assets. How to report Federal return.

Short-term capital gains are taxed at your ordinary-income tax rate while long-term capital gains are taxed at a lower rate. It does not recognize the distinction between short-term and long-term capital gains. Tax rates may vary as low as 1 or as high as 13 depending on the source of the capital gains and an individuals tax bracket.

These numbers have the ability to fluctuate slightly based on income. They can range between 1 and 133 based on your income tax bracket. California Capital Gains Tax 2019At the federal level the capital gain rate is 20 for higher income taxpayers.

California has notoriously high taxes and with up to 396 in federal taxes alone the state taxes can seem especially deep. California Capital Gains Tax Rate 2021. Individual Income Tax Return IRS Form 1040 and Capital Gains and Losses Schedule D IRS Form 1040.

The tax rate for capital gains that is long-term rate is zero per cent fifteen percent and 20 percent depending on your income tax taxable and filers status and also your filing status as well as the number that capital gains that you have earned. The golden state also has a sales tax of 725 the highest in the country. Learn more and how they can impact you.

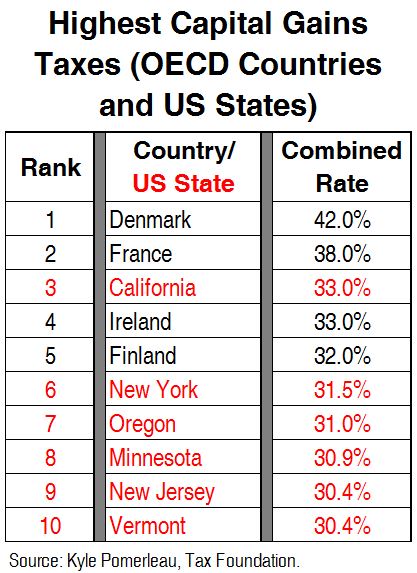

The combined state and federal capital gains tax rate in California would rise from the current 371 percent to 567 percent under President Bidens American Families Plan according to a new study from the Tax Foundation. This means your capital gains taxes will run. These states typically make up for their lack of overall tax income with higher sales and property taxes.

California income and capital gains tax rates. Capital gains tax rates on most assets held for less than a year correspond to. All capital gains are taxed as ordinary income.

2020 capital gains tax ratesLong-term capital gains tax rateYour income00 to 800001580001 to 49660020496601 or more. Taxpayers in the 25- 28- 33- or 35- percent income tax brackets face a 15 percent rate on long-term capital gains. Instead capital gains are taxed at the same rate as regular income.

Net investment income tax. If you have a difference in the treatment of federal and state capital gains file. Know what assets are subject to Capital Gains Tax.

It is common practice to charge 28 per cent tax on long-term capital gains on what are known as collectible assets which comprise items such as coins gold and silver bullion antiques as well as fine art. Simply put California taxes all capital gains as regular income. Capital gains tax rates on most assets held for less than a year correspond to ordinary income tax brackets 10 12 22 24 32 35 or 37.

For those in the top 396 percent. 9 rows With California not giving any tax breaks for capital gains you could find yourself getting. 10 rows California Capital Gains Tax Rates.

Given that California taxes net capital gains at the same rates as ordinary incomewith a maximum rate of 123 percent or 133 percent with respect to taxable income in excess of 1000000an otherwise out-of-state trust may have significant California income tax. 4 rows The capital gains tax rate California currently plans for is one that can vary widely. To report your capital gains and losses use US.

If the house has been owned for less than a year there will be a 15 capital gains tax applied. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for more than a year. California has notoriously high taxes and with up to 396 in federal taxes alone the state taxes can seem especially deep.

Understand the difference between short-term and long-term Capital Gains Tax. While some individuals can see Californias lowest capital gains rate the average for investors and other passive income from capital gains rates is the higher percentage of 13. The proceeds from the sale an asset that is held for more than a year are subject to long-term capital gains tax.

Unlike other states California taxes capital gains as normal income. Investment gains are taxed at the normal rate of taxation on short-term profits from such assets. The following are the income thresholds for 15 and 20 rates.

The capital gain rates vary between different buyers. What is the capital gains tax rate in California. California has the highest capital gains tax rate of 1330.

Federal Capital Gains and Losses Schedule D IRS Form 1040 or 1040-SR California Capital Gain or Loss Schedule D 540 If there are differences between federal and state taxable amounts Visit Instructions for California Schedule D 540 for more information. Because California does not give any tax breaks for capital gains you could find yourself taxed at the highest marginal rate of 123 percent plus the 1 percent Mental Health Services tax. Currently individuals making 254250 to 305100 a year pay 103 in taxes with the rate increasing to 133 for those making 1 million or more.

If the home was owned for a period of time greater than one year the rates would be 20.

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

12 Ways To Beat Capital Gains Tax In The Age Of Trump

How Do State And Local Individual Income Taxes Work Tax Policy Center

A Programmer Tries To Figure Out How Capital Gains Tax Actually Works By Fpgaminer Hackernoon Com Medium

2021 Capital Gains Tax Rates How They Apply Tips To Minimize What You Owe

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

2022 Income Tax Brackets And The New Ideal Income For Max Happiness

Capital Gains Taxes Are Going Up Tax Policy Center

Biden S Plan Raises Top Capital Gains Tax Rate To Among Highest In World

2.png)

How High Are Capital Gains Tax Rates In Your State Tax Foundation

Crypto Tax Rates Capital Gains Tax A Break Down On How It All Works

What S Your Tax Rate For Crypto Capital Gains

How To Avoid Capital Gains Tax When Selling Your Home

Fusione Pointer Parana River Federal Capital Gains Tax Calculator Rmphoto It

How High Are Capital Gains Taxes In Your State Tax Foundation

Capital Gains Tax Rate In California 2022 Long Short Term Seeking Alpha